Table Of Content

- What kind of information does Bankrate use to calculate my home's value?

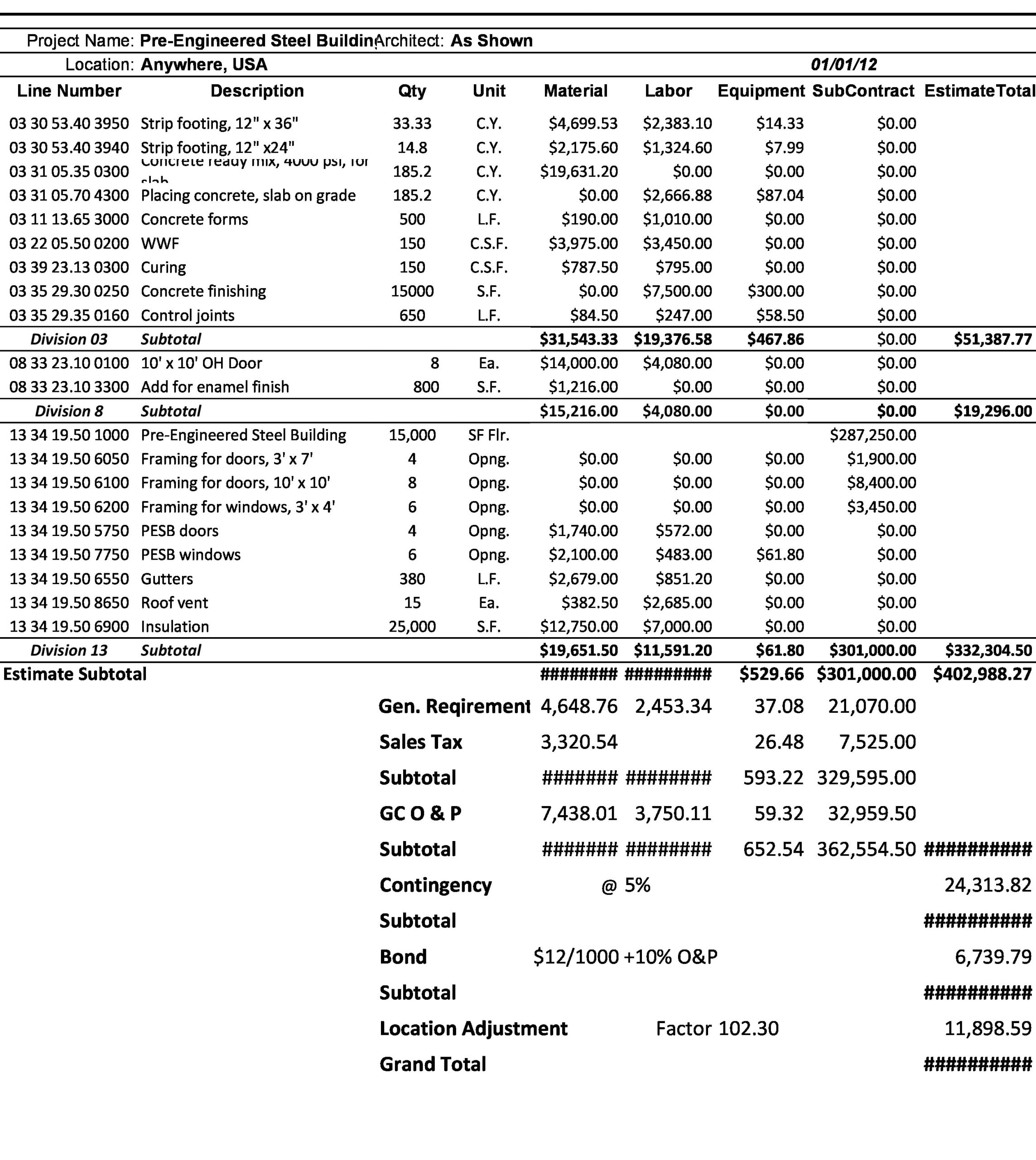

- Approximate cost on various work of material to complete the construction

- Average Time On Market

- Ready to sell?

- How accurate are online home value estimates?

- As you set out on your home search, it is important to know the following:

- Start your home buying research with a mortgage calculator

Once you have a projected rate (your real-life rate may be different depending on your overall financial and credit picture), you can plug it into the calculator. To ensure the most accurate Zestimate, report all home updates to your local tax assessor. Unreported additions, updates and remodels aren’t reflected in the Zestimate.

What kind of information does Bankrate use to calculate my home's value?

Mortgage calculator: See how much higher rates could cost you - Fox Business

Mortgage calculator: See how much higher rates could cost you.

Posted: Thu, 08 Jun 2023 07:00:00 GMT [source]

Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. Most recurring costs persist throughout and beyond the life of a mortgage. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox.

Approximate cost on various work of material to complete the construction

Financial advisors can also help with investing and financial plans, including retirement, taxes, insurance and more, to make sure you are preparing for the future. To remedy this situation, the government created the Federal Housing Administration (FHA) and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

Average Time On Market

With those rules, California’s effective property tax rate is just 0.71%. On the local and county level, additional taxes can be levied if you live in a special district that’s financing an improvement or other local concern. In addition to making your monthly payments, there are other financial considerations that you should keep in mind, particularly upfront costs and recommended income to safely afford your new home. Redfin displays its own home value estimates on the home profiles on its website.

Ready to sell?

By 2001, the homeownership rate had reached a record level of 68.1%. Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

Any additional services will cost extra, but may help you discover serious issues prior to moving in, such as a mold infestation. California doesn’t have as high of risk for radon as some regions in the U.S. However, there are some areas, such as Tulare, that are depicted as having high concentrations of radon, according to the California Department of Conservation’s indoor radon potential map. You’ll want to check to see if your property is in one of those high-risk areas. The major part of your mortgage payment is the principal and the interest. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it.

As you set out on your home search, it is important to know the following:

Free online home valuations can be viewed as snapshots in time, pulled from a variety of different public sources and data models, which give accurate property estimates. This is very useful when monitoring your investment over time to determine how much equity you have in your home to refinance or if you are simply in the market to purchase your next home. You can compare valuations to a seller’s listing price or keep an eye on a specific neighborhood that you wish to move to in the future. A mortgage loan term is the maximum length of time you have to repay the loan.

Start your home buying research with a mortgage calculator

The more info you’re able to provide, the more accurate your total monthly payment estimate will be. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. The Federal Housing Administration (FHA) is an agency of the U.S. government.

About the Redfin Estimate

There are no guarantees that you’ll sell for the amount you see, but the results can give you a solid ballpark idea of your home’s approximate value. Whether you’re thinking about selling or refinancing your current home, or buying a new one, it’s important to know how a property is valued in today’s market. For your current home, you’ll have a good estimate of how much you may receive from a buyer, or how much equity you may be able to borrow against after an appraisal. If you’re shopping for a home, you’ll be able to estimate your homebuying budget and find great prospects to match. It will also be useful to check other similar homes in the area to make sure your offer is competitive. An FHA loan is government-backed, insured by the Federal Housing Administration.

We recommend that real estate agents and other professionals gain a basic understanding of how the Zestimate is calculated and how to read the Zestimate data accuracy table. This will help them explain to their clients why the Zestimate is a good starting point and historical reference, but should not be used for the final pricing of a home. The Zestimate® relies on a proprietary set of models, but also incorporates inputs that are provided by users on their site. For example, property owners can update their home’s information on the site after a renovation has occurred. Note that there are many factors that may have an effect on home value. While tools like this can account for neighborhood comps, trends in real estate markets, and other factors, there is some information that no estimation tool can always account for.

However, there are risks and drawbacks to consider, so it’s best to do your research to ensure a home equity loan suits your needs. For a mortgage loan, the borrower often is also referred to as the mortgagor (and the bank or lender the mortgagee). The state also runs the Department of Consumer Affairs Bureau of Real Estate. This entity was created to protect public interest and increase consumer awareness in real estate transactions.

The Zestimate incorporates public and user-submitted data, taking into account home facts, location and market conditions. Pennymac leverages a best-in-class AVM often used by mortgage lenders and other real estate professionals for forecasting, as well as initial loan estimates. This will prevent automated valuations from showing on all third-party real estate sites. You won’t have to worry about mortgage tax, as California does not charge buyers for purchasing a home, like New York does. Generally, the seller in California will pay the city transfer tax or split it with the buyer.

Go to Chase home equity services to manage your home equity account. Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area.

Mortgage lenders require an appraisal before they will approve your loan. Our report includes overall value, estimated price per square foot, property details, sales history of nearby homes and value history. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Many factors can affect your home's value, including buyer demand and prices of neighboring homes. The Redfin CompeteScore can give you an idea whether market competition in your area could boost your home's sale price. Or if you're buying, it can indicate how much competition you'll face when you make an offer.

No comments:

Post a Comment